Executive Summary

- In recent years LATAM has become a key destination for companies looking to outsource customer and tech support roles.

- India remains the top outsourcing destination, but LATAM has recently surpassed the Philippines, with nearly 1 million employees at top major companies US firms outsource.

- Two recent changes in the market may explain this shift: First, salaries for customer and tech support roles in LATAM have stagnated and are now on par with those in India, making it a cost competitive destination.

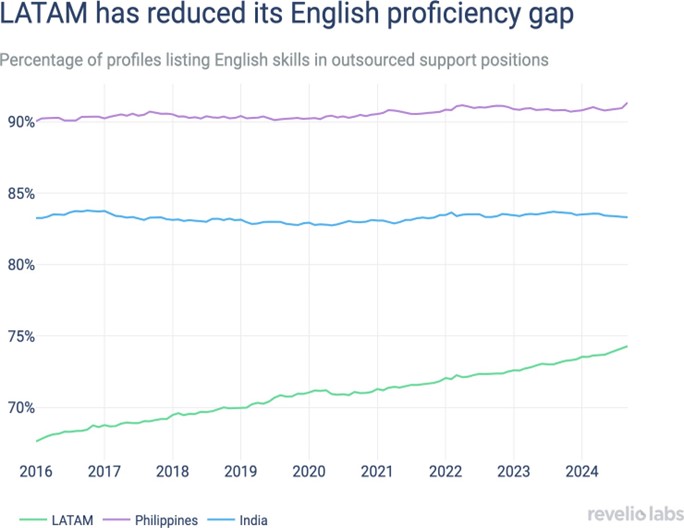

- Second, LATAM has been steadily closing the English proficiency gap, a fundamental requirement for client facing positions that US companies may be looking to outsource.

Introduction

The global outsourcing landscape is shifting, with Latin America emerging as a prime destination for US-based companies offshoring critical business functions. Driven by the region’s unique blend of cost competitiveness cultural affinity and logistical advantages, this trend is redefining the way American enterprises approach global talent acquisition and management.

As demand for specialized skills grows, companies are looking beyond traditional hubs to capitalize on Latin America’s potential. With a favorable business environment, skilled workforce and negligible time zone differences, LATAM is fast becoming the go-to destination for outsourced services such as help desks, remote assistance and tech support.

This shift in outsourcing raises questions about the trend’s drivers, its implications for US businesses and the potential benefits and challenges of outsourcing critical functions to offshore destinations, including LATAM. This whitepaper explores LATAM’s rise as a major outsourcing hub, its growth factors and its impact on global business operations.

Which Roles are best suited for Outsourcing?

Not all roles are equal when it comes to their propensity to be carried out remotely. These roles are often —but not always— repetitive in nature, require specific skills, metrics for performance evaluation. Outsourcing these roles can help companies reduce labor costs, increase efficiency and scalability and focus on core business functions.

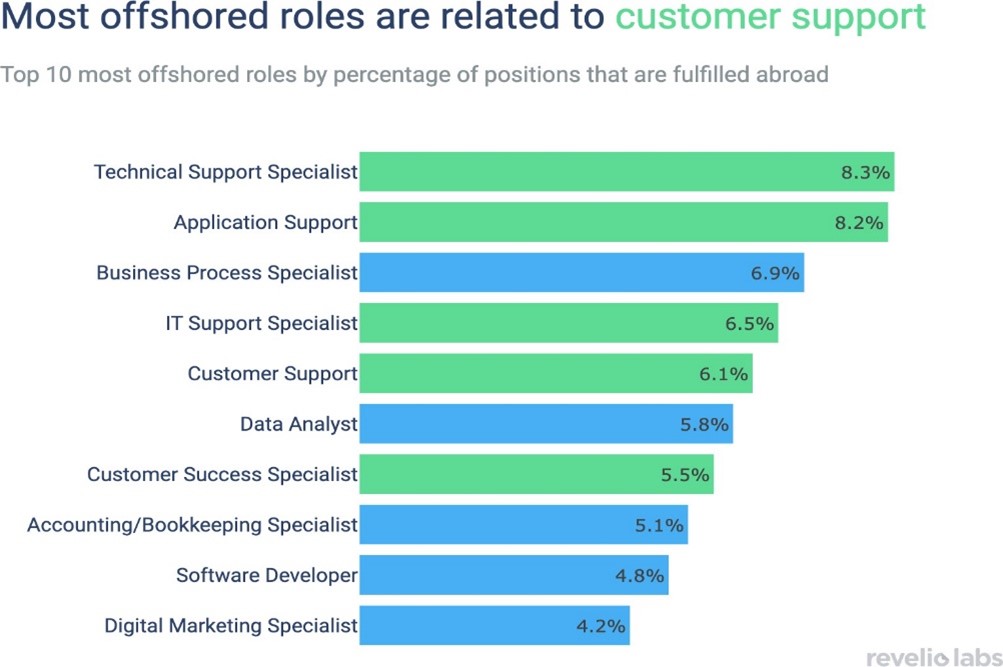

Below, we analyze the top occupations in terms of outsourcing potential. We identify these by looking at the share of roles at US companies that are fulfilled from abroad.

The top roles in Latin America outsourcing companies include customer support and technical support: currently, as much as 8% of customer support-related positions are performed from abroad.

For the remainder of this article, we focus our attention on those positions.

LATAM: One of the Top Outsourcing Destinations

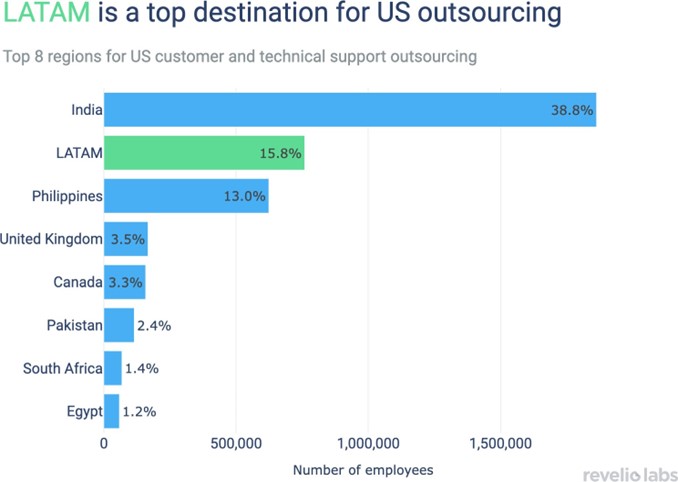

Next, we focus our analysis on firms that outsource Latin America services to US-based companies. Using company descriptions and competitor relationships we identify the largest actors in the customer and technical support market, close to 200 firms with a total headcount of over 6.8 million employees. By analyzing employee profiles, including location, we can identify the countries where these services are being outsourced.

Below we plot the top 8 regions for US customer and tech support outsourcing.

The top destinations usually possess a high degree of English proficiency or low salaries and sometimes both. Without question, India continues to be the top offshore destination for outsourcing of customer and technical support functions: approximately one in three roles that are outsourced are fulfilled in India. As a region, LATAM is second with 18.6% of these roles. Its closest competitor, the Philippines, is the destination of 12.6% of outsourced roles and all other countries claim less than 4% of roles.

LATAM on the Rise

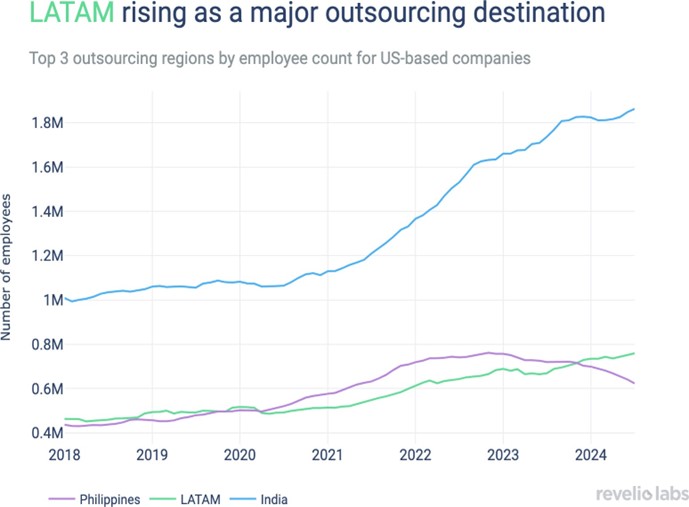

The combination of native English speakers and low labor costs has made India a prime outsourcing destination. Currently, over 1.8 million India-based employees fulfill customer and tech support roles for US companies, a number that surged after the 2020 pandemic and firmly positions India as the top outsourcing destination.

The Philippines is a solid—albeit not close— second player, with 0.6 to 0.8 million employees in the same roles. Interestingly, its numbers have not seen the growth rate observed in India, especially after 2022. On the other hand, LATAM countries have seen a steady increase in market share and have now surpassed the Philippines in order to become the second largest outsourcing destination. While LATAM includes a number of countries, it remains impressive how the region has matched the growth rate of the largest and most established destination in this market.

Factors Driving LATAM’s Outsourcing Growth

There are several intrinsic factors that explain why LATAM countries are a desirable outsourcing destination for US-based companies. Logistically, it has close proximity and close to zero time differences, which makes operations smoother.

Culturally, it has a significant degree of alignment with the US. Language-wise, almost all LATAM countries natively speak Spanish, which is the second most spoken language in the US. These represent structural comparative advantages with respect to other major outsourcing destinations.

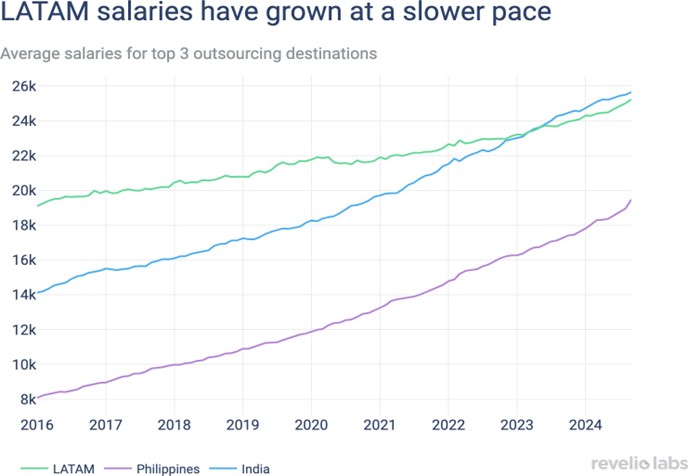

In addition, two dynamic workforce changes in the last 10 years can further explain the rise of LATAM as an outsourcing destination. The first reason concerns workforce cost. Historically, employees in customer and tech support services based in LATAM enjoyed average salaries 50% higher than their counterparts in India, and more than double that those in the Philippines (2016).

1. LATAM’s Salary Growth Stagnation

However, in recent years, the average salary growth rate in LATAM has stagnated compared to these two countries. Salaries are now much more competitive for potential employers. As the figure below shows, Indian salaries in these roles have surpassed those in LATAM. The gap with the Philippines has decreased to only 29% higher salaries on average.

2. LATAM’s Closes the English Proficiency Gap

Secondly, English proficiency in LATAM has rapidly improved, with the region growing its English-speaking workforce by nearly 3% annually. India and the Philippines have high English proficiency in customer and tech support roles, but these numbers remain flat. LATAM is “closing the gap” in English proficiency, making it a more competitive destination for US outsourcings.

LATAM’s rise as an outsourcing hub for US companies is driven by cost competitiveness, cultural affinity, logistics, and improving English. Moreover, salaries in LATAM have stagnated, increasing its competitiveness with India and the Philippines. Meanwhile, as English proficiency continues to improve, the region is poised to sustain its growth trajectory.

With structural advantages and workforce changes, LATAM is becoming a key hub for outsourced customer and tech support. It redefines the global outsourcing landscape and offering US businesses a compelling alternative to traditional offshore destinations.

Click here to access our latest whitepapers and expert insights. Stay connected—follow us on LinkedIn for more updates!

References:

Latest data on outsourcing destination

https://www.statista.com